Now, trades are virtually free on most platforms. Before Robinhood, users could easily be expected to pay upwards of $10 per trade. Almost all investing platforms now allow users to begin investing with no minimums. Though Robinhood was the first, it has certainly not been the last to offer commission-free trades with no account minimum. This brokerage platform strives to provide the most when it comes to commission-free trading, fractional shares, a high-yield savings account, and much more. Many love Robinhood because its trading platform contains a sufficient amount of data for the average investor without many of the confusing indicators necessary for more advanced trading. This brokerage is famous for a clean and simple user interface. Robinhood's credo is based on accessible trading for all, regardless of their account size.

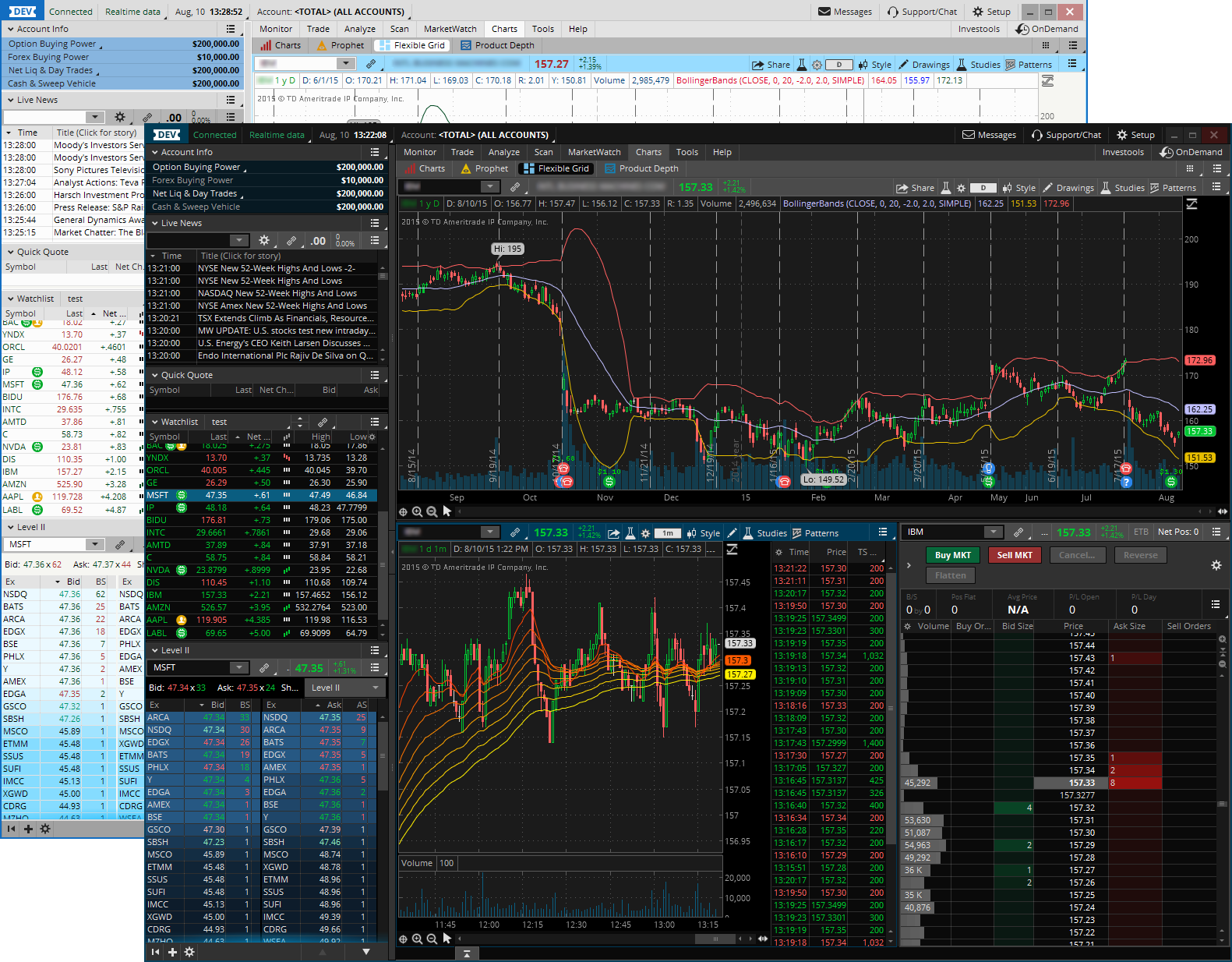

This platform launched over eight years ago in 2013 and pioneered democratized investing. Robinhood is a simple and beginner-friendly investing app without minimum account balances or commissions. Yes (free stock when you sign up worth$2.50 - $225) Stocks, ETFs, Options, Cryptocurrencies, ADRs Stocks, Bonds, Mutual Funds, ETFs, Options, Futures, Forex, Foreign ADRs, and IPOs for Qualified Accounts $0 for stocks, ETFs, and options (plus 4,100 mutual funds without transaction fees) However, each app has a specific target niche and attracts users to their platforms for very different reasons. However, this also means that the platform has occasionally been slow to adapt to change.īoth apps allow users to trade stocks, ETFs, and options commission-free. This platform has been in business for decades which makes it a trusted brand. The tools and resources give day traders and long-term investors everything they need to succeed. TD Ameritrade tailors its experience to active traders.

The clean and crisp product design appeals to both long- and short-term investors but the lack of a retirement offering or detailed technical analyses means it's best for casual traders. The platform is simple and easy to use, allowing beginners to start trading with few barriers. Robinhood was the pioneer in commission-free trading. We will be covering the similarities, differences, and pros and cons between each of these brokerages. In this article, we will provide an in-depth comparison of Robinhood and TD Ameritrade. However, either platform is a solid starting point for beginners though one is better suited for advanced traders. But just which one is right for you? Depending on investing goals, this answer could vary for most. TD Ameritrade and Robinhood are both well-established and powerful players in the retail investing space.

0 kommentar(er)

0 kommentar(er)